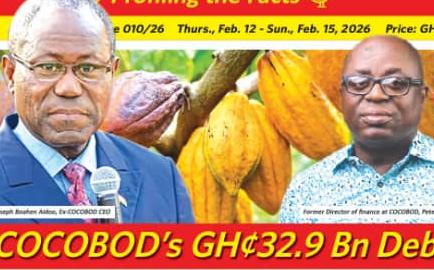

COCOBOD’s GH¢32.9 Billion Debt: Former CEO, Finance Director and Others’ Silence Questioned

The deepening financial crisis at the Ghana Cocoa Board (COCOBOD) has raised concerns over the silence of some former top officials who superintended the affairs of the state-owned institution during the period leading to its current debt burden.

COCOBOD’s Chief Executive Officer (CEO), Dr. Randy Abbey, disclosed in an interview on The Point of View on Channel One TV last Monday, February 9, that the Board’s total debt stood at GH¢32.9 billion as of the end of 2024.

However, former officials who managed the institution’s finances over the past eight years have remained largely silent, allowing political actors to play politics with the issue.

Industry insiders contend that former CEO, Joseph Boahen Aidoo; former Deputy Chief Executive in charge of Finance and Administration, E. Ray Ankrah; and former Director of Finance, Peter Osei-Amoako, must account for their stewardship during the period under review.

Mr. Osei-Amoako, who served as Director of Finance from January 2017 to February 2025, is described by insiders as a powerful figure within the previous management structure.

He previously served as Senior Accounts Manager from April 2015 to December 2016, Accounts Manager from July 2006 to March 2015, and Deputy Accounts Manager from September 2004 to June 2006.

Sources allege that key financial and procurement decisions taken during their tenure significantly contributed to COCOBOD’s current liabilities.

Among the issues raised are claims of last-minute procurement transactions amounting to millions of dollars weeks to the New Patriotic Party’s (NPP) exit from office.

Reports indicate that a payment of US$13.125 million was authorised shortly after the appointment of a new Director of Procurement, Mr. Stephen Badu.

The payment, allegedly approved on Mr. Badu’s first day in office, was made to Awo Henewah Limited for the supply of agricultural inputs.

The items reportedly included spraying machines, rechargeable lights for cocoa farmers, Wellington boots, fertilisers and insecticides.

Awo Henewah Limited was contracted to supply 250,000 50kg bags of Asaase Hene fertiliser at US$52.50 per bag.

In a letter dated December 9, 2024, the company’s General Manager, Joseph Ackon, requested payment and attached an invoice for the full amount.

The letter was received by COCOBOD on December 11, 2024 — the same day Mr. Badu reportedly assumed office.

Mr. Badu is said to have forwarded the letter to the Deputy Procurement Manager, Mr. Seth Naggai Tetteh, who subsequently passed it on to the Principal Procurement Officer, Mr. Maxwell Peter Arthur, for processing.

Observers within the sector have questioned the timing and speed of the authorisation, describing it as unusual and warranting further scrutiny.

Meanwhile, critics argue that the current management of COCOBOD and the Mahama administration must expedite procurement audits and ensure accountability where infractions are established.

GH¢32.9 billion debt

Dr. Abbey has attributed the GH¢32.9 billion debt burden to a combination of legacy debts, uncrystallised contract obligations and procurement lapses.

He cited several major expenditure commitments, including a US$48 million jute sack procurement programme, which he said continued annually despite existing stock not being cleared.

“COCOBOD kept procuring jute sacks without clearing previous stock, spending about US$48 million in the process,” Dr. Abbey stated.

He also referenced cocoa road projects that reportedly cost GH¢26 billion, with GH¢21 billion incurred during the 2018/19, 2019/20 and 2020/21 crop seasons, despite the absence of specific budgetary allocations for cocoa roads during those periods.

Dr. Abbey stressed that the scale of the inherited financial obligations underscores the urgent need for structural reforms to stabilise COCOBOD’s finances and restore confidence in the cocoa sector.

The developments have intensified calls for transparency, accountability and comprehensive financial audits to determine the full extent of the Board’s obligations and the decisions that led to its current position.